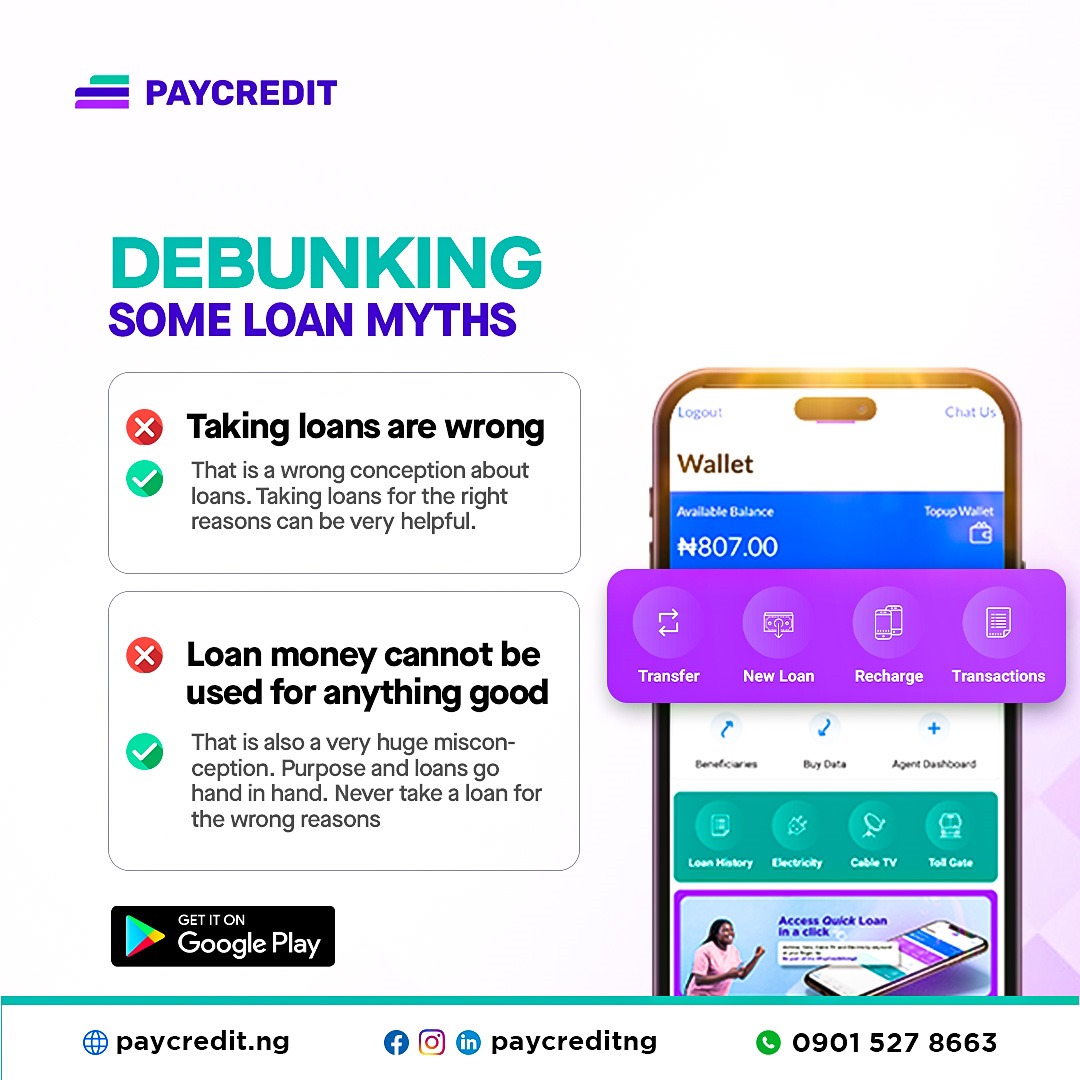

1. Misconception: Taking Loans is Always Wrong There's a prevailing belief that taking out a loan is inherently bad. However, this couldn't be further from the truth. When used for the right reasons, such as investing in education, starting a business, or purchasing a home, loans can pave the way for financial growth and stability. It's essential to distinguish between responsible borrowing and reckless spending. Instead of avoiding loans altogether, individuals should focus on making informed decisions and borrowing only what they can afford to repay.

2. Misconception: Loan Money Can't Be Used for Anything Good Another misconception is that loan funds are inherently tainted and can only lead to financial trouble. The reality is that the purpose behind a loan determines its impact. Using borrowed money to finance a promising business venture, improve one's skills through education, or invest in real estate can yield significant returns in the long run. However, it's crucial to avoid using loans for frivolous expenses or purchases that don't generate value or contribute to personal or professional growth.

While it's essential to approach borrowing with caution and diligence, loans shouldn't be demonized. When utilized wisely and for the right purposes, loans can serve as valuable resources for achieving financial goals and improving one's overall financial well-being. By dispelling these misconceptions and adopting a more nuanced view of loans, individuals can leverage them effectively to create opportunities for success and prosperity.