January has a reputation — and for good reason. After December spending, the first month of the year often feels longer, tighter, and more demanding financially. Salaries feel smaller, bills feel heavier, and payday seems far away.

That’s why one simple rule matters this month: plan your spending early.

Why January Feels So Tough

Several factors make January financially challenging:

-

Post-holiday expenses

-

Reduced cash flow

-

Ongoing bills and responsibilities

-

Emergency expenses that don’t wait

Without a plan, money disappears faster than expected.

How Early Planning Helps

When you plan your spending early, you:

-

Control your expenses instead of reacting to them

-

Reduce impulse spending

-

Avoid unnecessary borrowing

-

Stay financially calm throughout the month

Planning gives you clarity and peace of mind.

Simple Ways to Plan Your January Spending

-

List your essential expenses first (food, transport, rent, utilities)

-

Set limits for daily and weekly spending

-

Track your expenses consistently

-

Leave room for unexpected needs

Small adjustments early can prevent big problems later.

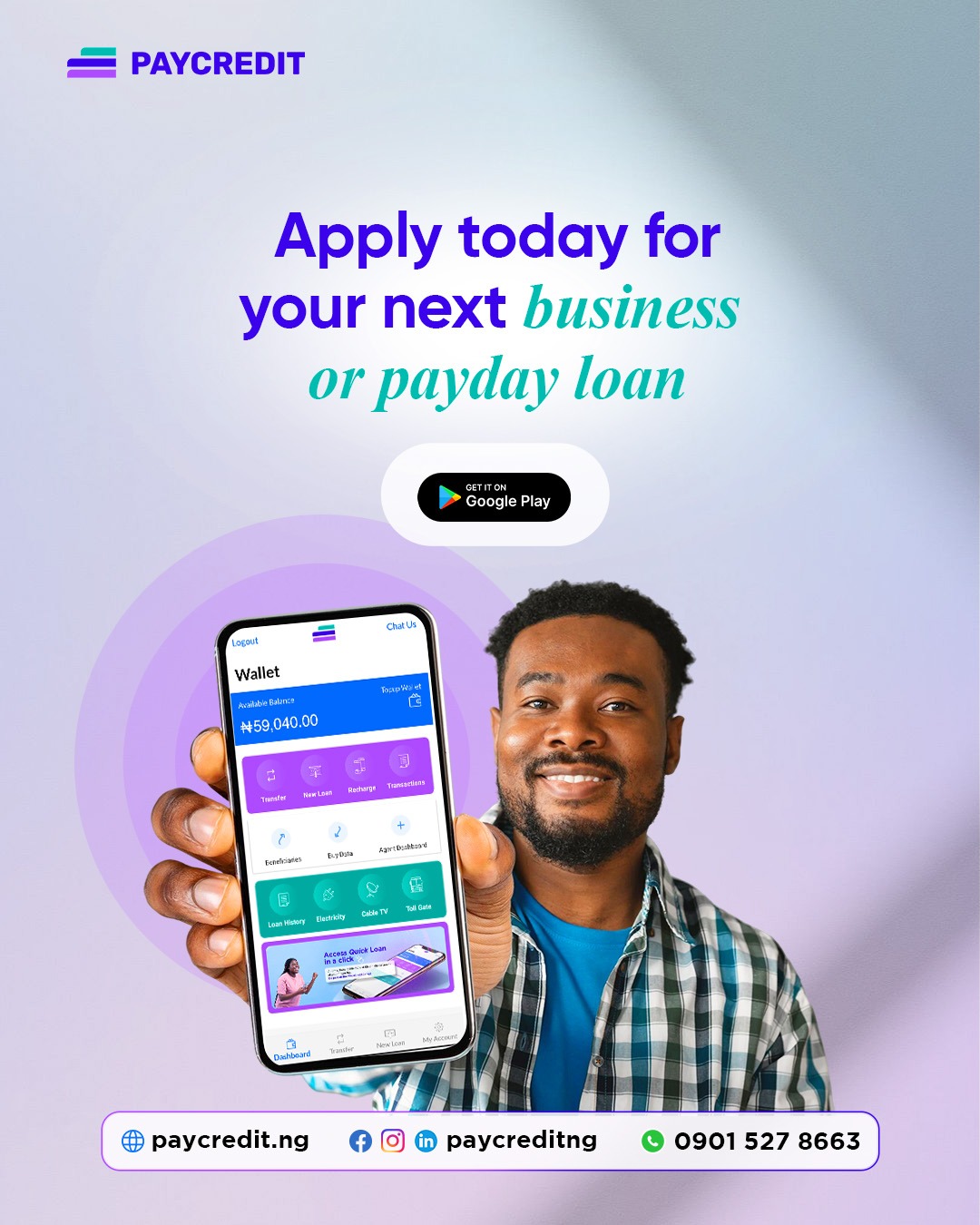

When You Need Extra Support

Even with planning, life happens. Unexpected expenses can arise at any time.

With PayCredit, salary earners and business owners can access ₦5,000–₦50,000 quickly to manage urgent needs without stress. Borrow responsibly and repay on time to stay eligible and unlock higher limits.

Final Thought

January doesn’t have to drain you financially. With early planning and smart decisions, you can move through the month confidently.

Remember: January is long — plan your spending early.

And whenever you need support, PayCredit is here for you.