A new year is the perfect time to reflect on how you manage your money — and more importantly, what you want to do differently.

Instead of setting unrealistic financial resolutions, focus on changing just one money habit. One consistent habit can completely transform your financial life over time.

So, we’re asking: What’s one money habit you’re changing this year?

Why One Habit Matters

Trying to change everything at once can be overwhelming. Focusing on one key habit makes it easier to stay consistent and see real results.

One strong habit can:

-

Reduce financial stress

-

Improve spending discipline

-

Increase savings

-

Strengthen your credit

-

Improve long-term stability

Powerful Money Habits to Consider

Here are a few impactful habits you might choose to adopt:

Tracking Your Spending

Knowing where your money goes helps you make better daily decisions.

Budgeting Monthly

A simple budget gives your money direction and reduces surprises.

Repaying Loans on Time

Timely repayment strengthens your borrowing profile and builds trust.

Reducing Impulse Spending

Pausing before buying helps you stay within your financial plan.

Saving Before Spending

Even small, consistent savings create long-term financial security.

Turning Intentions Into Action

Choosing a habit is just the beginning. The real change comes from:

-

Writing it down

-

Setting simple reminders

-

Tracking your progress

-

Staying consistent, even when it’s not perfect

Progress beats perfection.

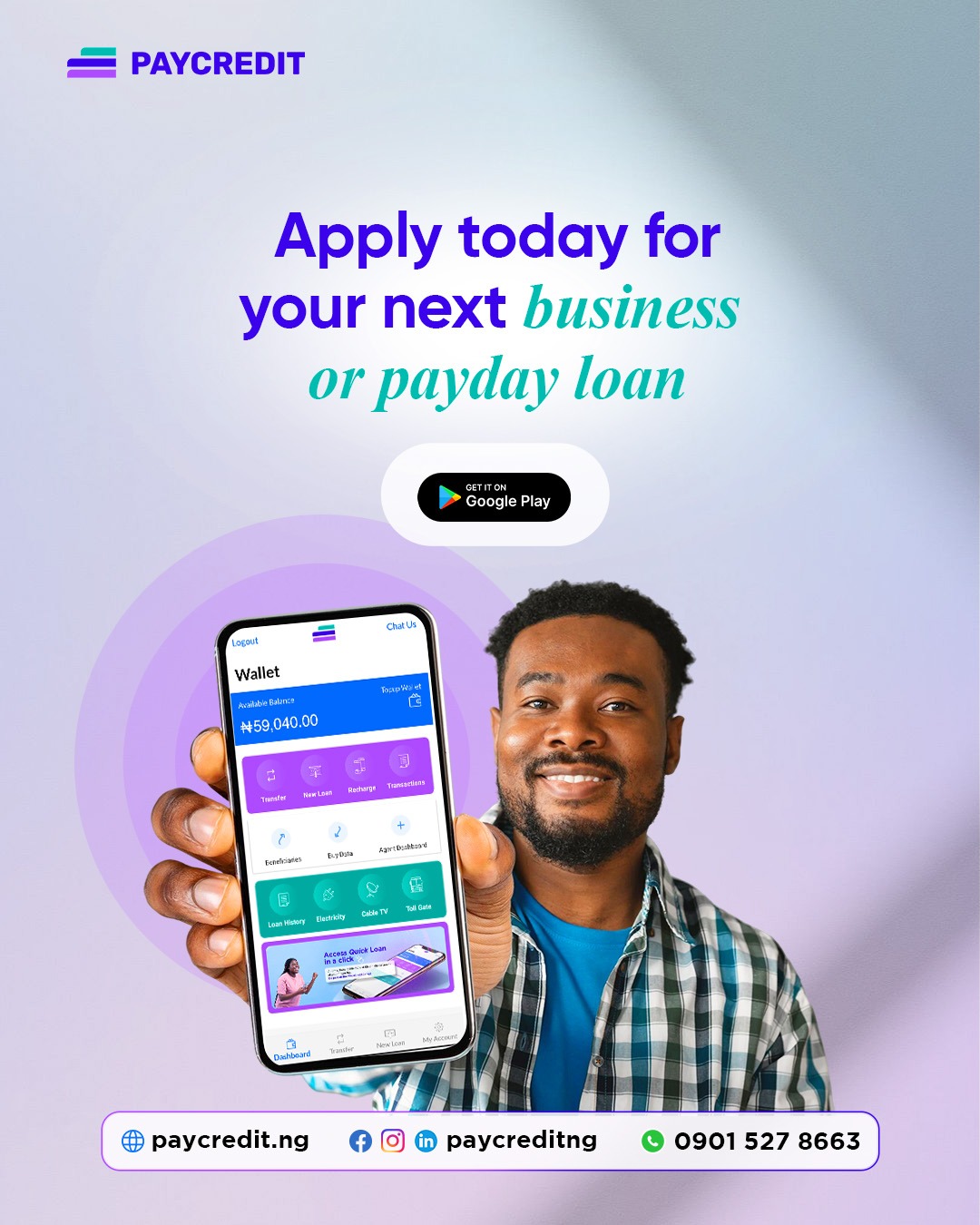

How PayCredit Supports Better Habits

At PayCredit, we believe in growth through responsible financial behavior. With fast, transparent loans between ₦5,000–₦50,000, we support your short-term needs while helping you build long-term discipline.

Borrow smart. Repay on time. Stay in control.

Final Thought

Your financial future is built one habit at a time. You don’t need to change everything — just start with one.

So tell us — what’s one money habit you’re changing this year?