When money gets tight, it doesn’t always take a huge amount to make things better. Sometimes, a small, timely loan is all you need to breathe again, handle urgent expenses, or keep things moving.

At PayCredit, we believe in one simple truth: small loans can bring big relief — when used wisely.

Why Small Loans Matter

Unexpected expenses happen — transport issues, food shortages, utility bills, business restocking, or family emergencies. Waiting until payday isn’t always an option.

Small loans help you:

-

Handle urgent needs quickly

-

Avoid financial panic

-

Maintain daily stability

-

Stay productive without disruption

It’s not about borrowing more — it’s about borrowing right.

The Power of Responsible Borrowing

Loans work best when they are used intentionally. Responsible borrowing means:

-

Borrowing only what you truly need

-

Using funds for essential expenses

-

Having a clear repayment plan

-

Repaying on time

These habits protect your finances and build trust for future access.

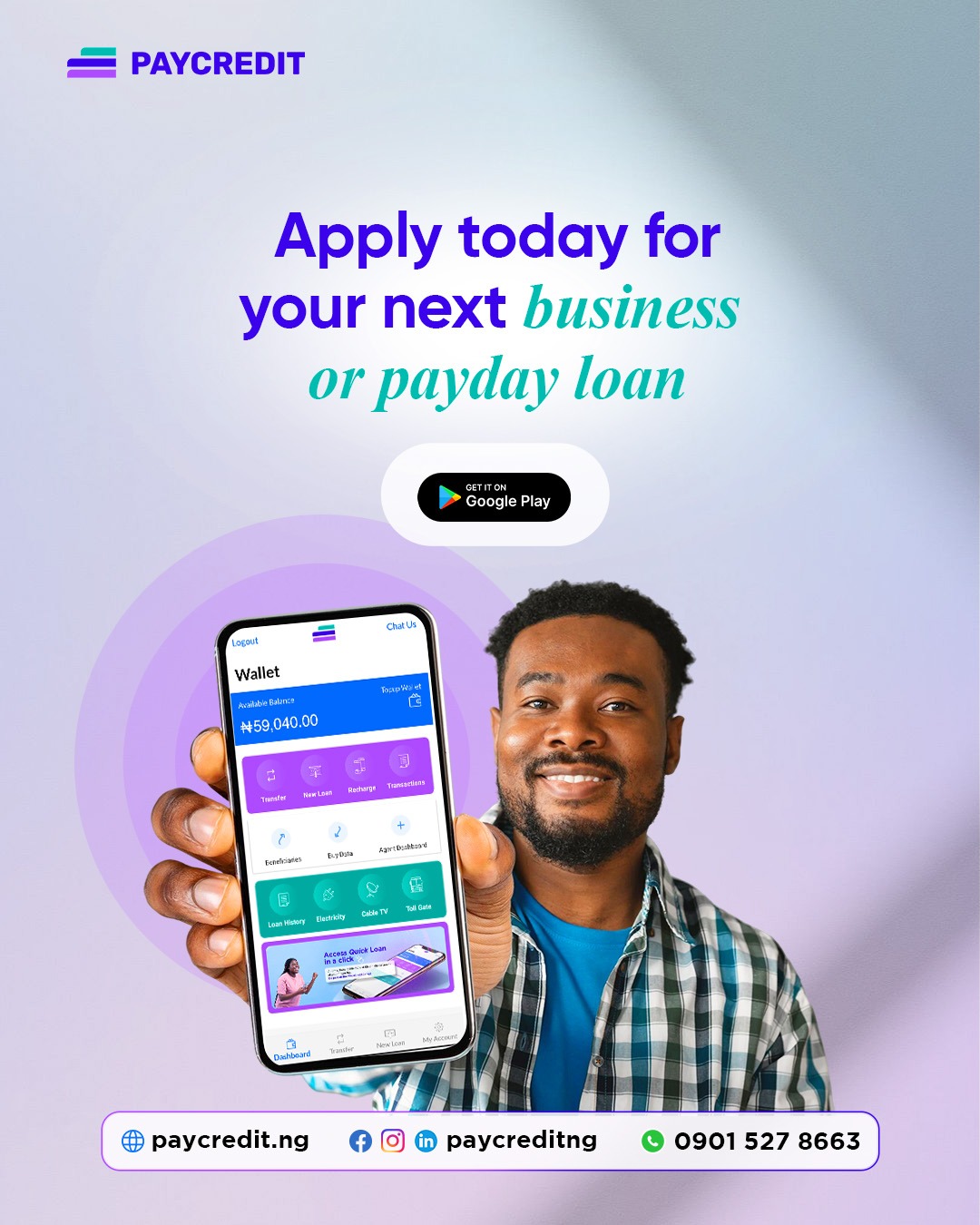

How PayCredit Supports You

PayCredit offers fast, transparent loans between ₦5,000–₦50,000 for salary earners and business owners across Nigeria.

With PayCredit, you get:

-

Quick access to funds

-

Clear repayment terms

-

No hidden charges

-

A simple application process

Borrow small. Repay smart. Unlock more.

Building Financial Confidence Over Time

Each responsible loan helps you grow financially. Timely repayments strengthen your borrowing profile and position you for higher limits in the future.

Small steps today lead to bigger opportunities tomorrow.

Final Thought

You don’t always need a big loan to fix a big problem. Sometimes, all it takes is a small boost at the right time.

Small loans, big relief — when used wisely.

And when you need that support, PayCredit is here for you.