If you’ve ever asked yourself, “Where did all my salary go?” — you’re not alone.

Between food, rent, fuel, school fees, and unexpected “urgent 2k” requests, your income can vanish faster than you can say “debit alert.”

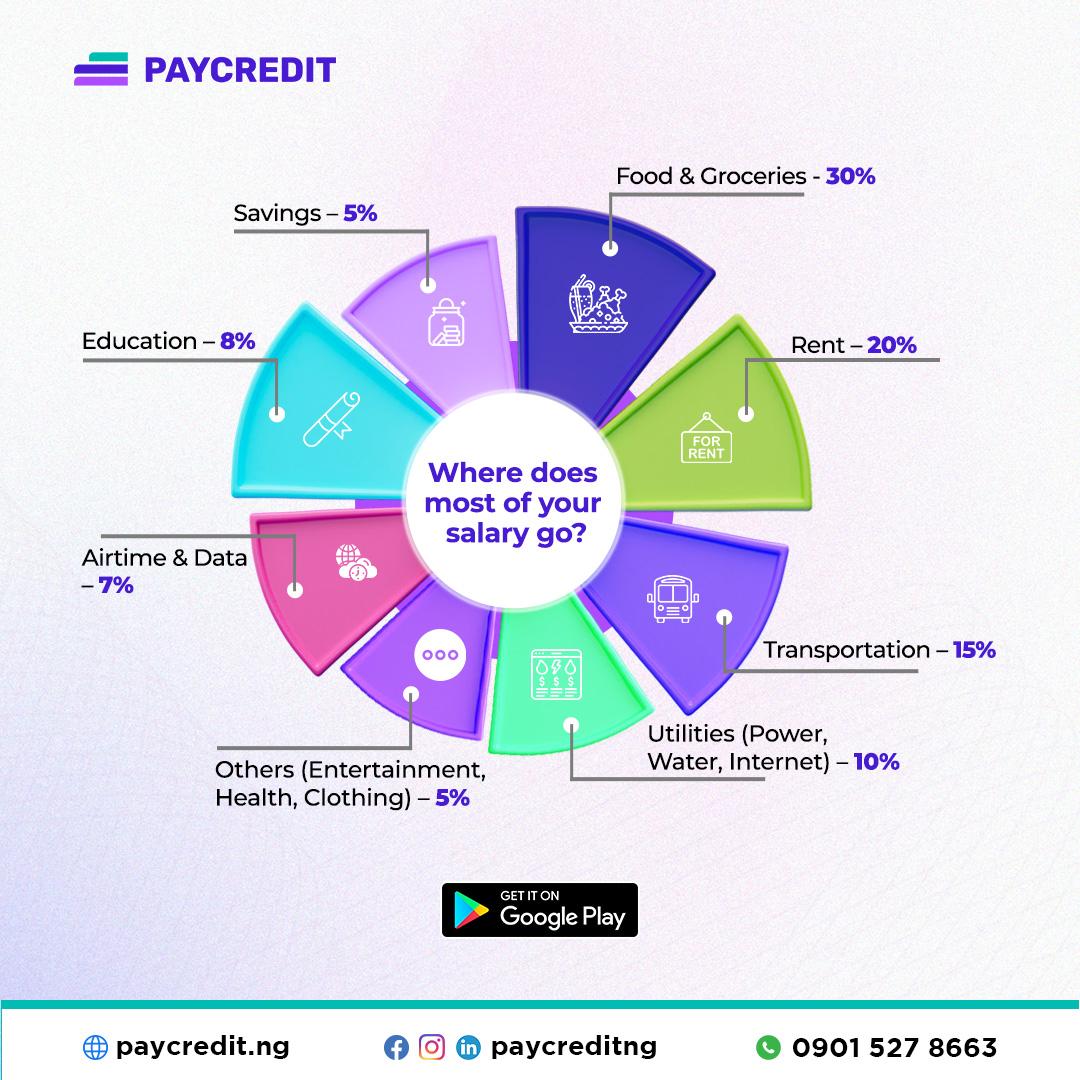

To help you understand your spending habits and plan better, here’s a simple breakdown of how many Nigerians typically spend their monthly income:

Average Salary Breakdown in Nigeria

-

Food & Groceries – 30%

The number one expense. From market runs to daily cooking or takeout, food gulps a large portion of income. -

Rent – 20%

Whether it’s yearly or monthly, housing takes a huge chunk, especially in urban areas. -

Transportation – 15%

Fuel, bike rides, danfo fares, or Bolt rides — movement isn't cheap anymore. -

Utilities (Power, Water, Internet) – 10%

Generator fuel, prepaid meter, water trucks, and data subscriptions add up quickly. -

Education – 8%

School fees, books, PTA levies — especially if you have kids or younger siblings to support. -

Airtime & Data – 7%

Calls, WhatsApp bundles, streaming… this one creeps up fast. -

Savings – 5%

For many, saving is what’s “leftover” — but it should be planned and intentional. -

Others (Entertainment, Health, Clothing) – 5%

The rest goes into weekend flexing, fashion, and health emergencies.

Why You Should Track This

If you don’t know where your money goes, it becomes hard to make better financial choices.

Understanding your spending habits helps you:

-

Create a smarter budget

-

Cut unnecessary costs

-

Save more consistently

-

Plan ahead for emergencies

Pro Tip from PayCredit:

Try writing down your expenses for just one month — every naira.

You’ll be shocked how ₦200 here and ₦500 there turn into thousands by month-end.

Final Thoughts:

Your salary is not small — your plan for it might be.

By understanding where your money goes, you take the first step toward financial control, not confusion.

Make this month different.

Track it. Budget it. Grow it.