Let's face it – life is full of surprises, and not all of them are pleasant. When unexpected expenses arise, it can feel like we're swimming against the tide, struggling to keep our heads above water. But rather than letting these challenges overwhelm us, there's a solution at hand: small loans.

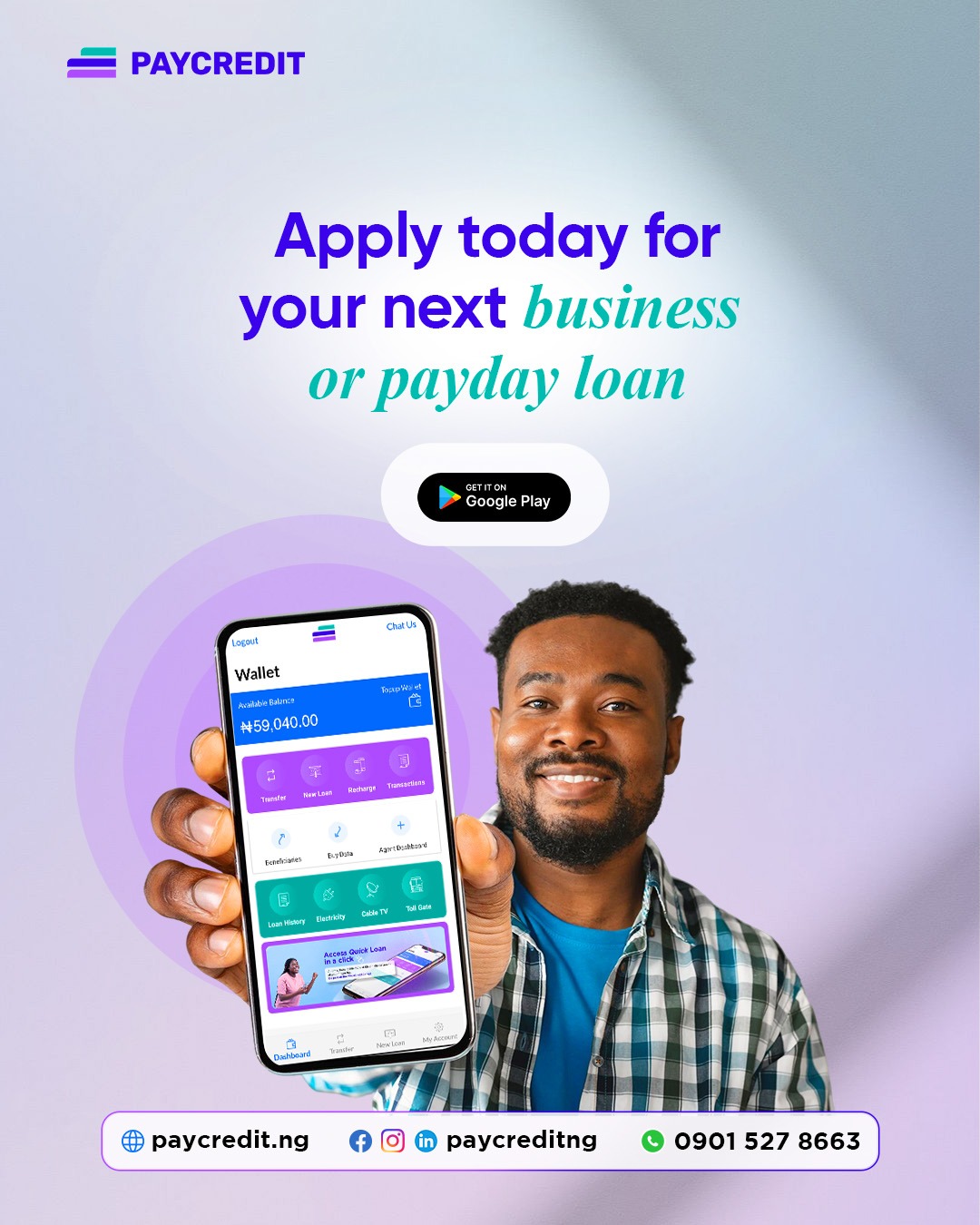

One of the greatest advantages of small loans is their ability to provide immediate financial relief. Whether you're facing a minor setback or a major financial hurdle, a small loan can bridge the gap between your current situation and your financial goals. With quick approval and disbursement processes, small loans offer peace of mind when you need it most.

By utilizing a small loan to cover this month's expenses, you're taking proactive steps towards financial empowerment. Rather than resorting to high-interest loan tenor or draining your savings account, a small loan allows you to maintain your financial stability while addressing immediate needs. This strategic approach sets the stage for long-term financial success and resilience.

Moreover, responsibly managing a small loan can have a positive impact on your credit score and financial confidence. By making timely repayments and demonstrating your creditworthiness, you're laying the foundation for future financial opportunities.

In conclusion, a small loan can indeed make a big difference in how you manage this month's expenses. By providing immediate financial relief, flexibility, and empowerment, small loans offer a lifeline in times of need. Whether you're facing unexpected expenses or seizing opportunities for growth, consider the benefits of a small loan in achieving your financial goals and navigating life's twists and turns with confidence.