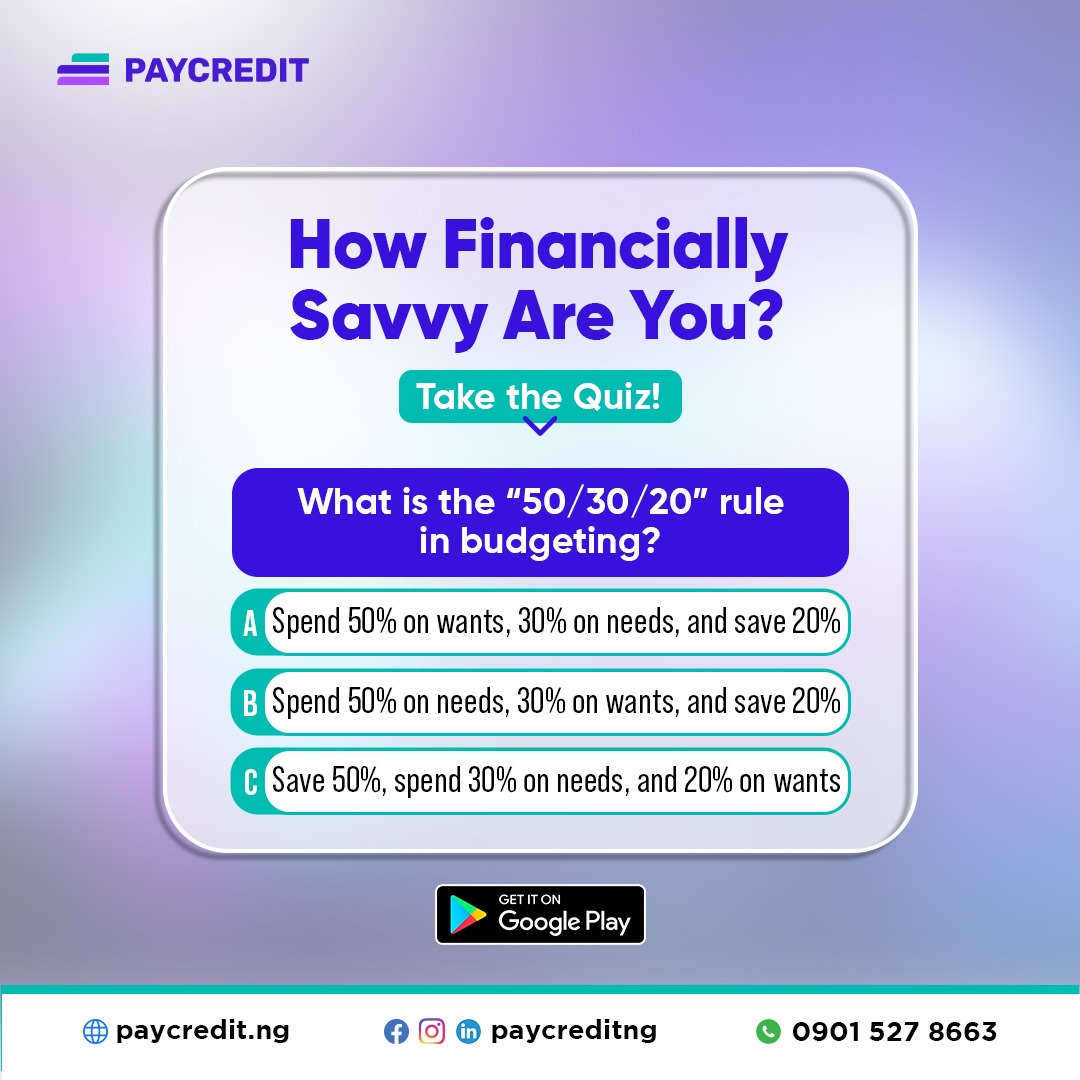

The Correct Answer: B. Spend 50% on Needs, 30% on Wants, and Save 20%

The 50/30/20 rule is a simple and effective way to manage your budget. According to this rule, you should:

-

Spend 50% of your income on needs: These are essential expenses like housing, groceries, utilities, and transportation—basically anything that you can’t do without.

-

Spend 30% of your income on wants: Wants are non-essential items that improve your quality of life, like dining out, entertainment, vacations, and shopping for things you enjoy.

-

Save 20% of your income: This portion should go toward savings, investments, or paying off debt. Building an emergency fund and contributing to long-term savings goals will help ensure financial security.

hy the 50/30/20 Rule Works

-

Easy to Follow

The simplicity of this rule makes it an excellent budgeting method for beginners and anyone who wants a clear, straightforward way to manage their money. -

Encourages Balance

By splitting your income into needs, wants, and savings, you can enjoy life’s pleasures while making sure your financial foundation is strong. -

Supports Financial Goals

Allocating 20% of your income to savings helps you build an emergency fund, pay off debt, or invest in your future. -

Flexible and Adaptable

You can adjust the percentages to fit your personal circumstances. For example, if you're saving for a big goal like a house, you might increase the savings percentage while cutting back on wants.

How Can You Apply the 50/30/20 Rule?

-

Track Your Income and Expenses

Start by understanding how much money you bring in and where it’s currently going. This will give you a clear picture of what adjustments you may need to make. -

Categorize Your Spending

Identify your needs, wants, and savings categories. Be honest with yourself about what falls into each category. -

Automate Savings

Make saving easier by setting up automatic transfers from your income to your savings account. -

Stay Consistent

Sticking to the 50/30/20 rule over time will help you build good financial habits and make it easier to manage your money.